Let's Talk About Why Businesses Fail (and, 3 Indicators to Avoid)

Author: Chris Heiler

Author: Chris Heiler

Let's talk candidly about this global pandemic and what it could mean to your business.

Difficult times are ahead for many of our lawn and landscape industry brethren as they will struggle to regain a foothold in the – hopefully near – post-pandemic economy. Let's face it, there's a "new normal" waiting around the corner.

All of us owners of businesses will face stiff challenges. Like being a small business owner doesn't have enough challenges already, right?!?!

But, that's the reality we're all facing.

Thinking about tomorrow...

I imagine some of you are scared and worried. I was certainly in crisis mode a few weeks back as I thought about the worst case scenarios facing my company, employees, and our clients.

We're all in the same boat. And that boat's a-rockin'.

That said, what I'm thinking about today are the steps we need to take tomorrow (and the next day...) to ensure for the financial stability of our companies moving forward. After all, you want to be the rock your family and employees can count on, right? You need to be the trusted partner who has their shit together when your customers and vendors need you most. Even in a crisis like we're currently facing.

So I want to talk openly about why businesses fail.

It's an important conversation to have right now.

You can either be aware of the most common financial pitfalls that lead to failure or you can bury your head in the sand. I believe you have more courage than the latter.

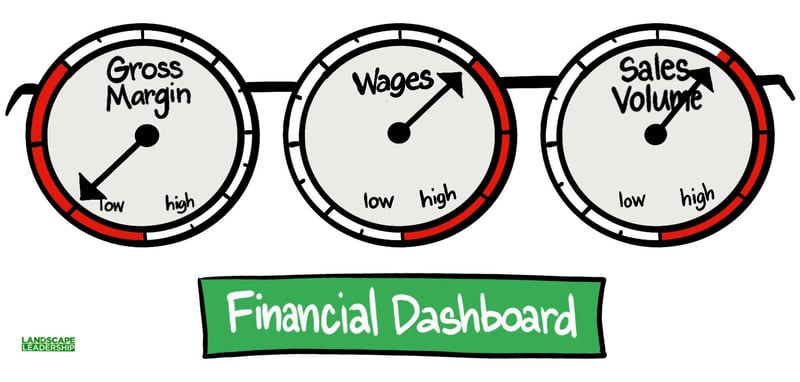

Below are three reasons businesses fail.1 There are others, obviously, but I want to focus on this dangerous combination in today's article and relate each back to the pandemic we're facing.

- The business experiences a period of declining gross margin while...

- Wages, as a percentage of sales, begin to increase as...

- Sales volume begins to increase.

These indicators are linked to each other. I recommend tracking them on a monthly or quarterly basis (we track these quarterly at Landscape Leadership as part of our Financial Scorecard).

Let's look at each...

1. Declining gross margin

[Gross Margin = Total sales - Cost of Goods Sold (COGS)]

Example: $40,000 = $100,000 - $60,000 (gross margin of 40%)

A declining gross margin is the symptom of a pricing problem.

The only way that gross margin (as a percentage of sales) can go down is if...

- You cut your prices while COGS remain the same, or...

- You fail to raise prices while COGS rise.

The bottom line is the same: The sales price is too low relative to the cost of goods sold.2

Cutting your prices (i.e.- discounting) is a death sentence. Especially as it relates to the present and post-pandemic economy. If your company is already nearing the edge of a cliff, cutting your prices will only push you over faster. Don't do it.

Scenario two is common in the lawn and landscape industry and, in my estimation, leads to failure more often than cutting prices. This is due to the lag time in raising prices after your COGS has increased. This lag can be years in the case of many companies.

I don't want to make a blanket recommendation because you're all in different situations right now. But, the majority of you would do well to heed this recommendation coming out of the pandemic:

- Raise your rates/prices (do not discount). In my opinion, this will not be completely unexpected by your customers and prospects.

- Cut or limit your production capacity. You don't need more customers right now, you need better customers. Now is the time to cut loose those clients who you are over-servicing and underpricing. There has never been a better time to clarify your positioning and become more relevant to fewer people.3

This should hopefully increase – or at least stabilize – your gross margin.

(I recommend reading these two articles about "managing your capacity"- here and here.)

2. Increasing wages

A second condition that normally prevails when any entity fails financially is that wages, as a percentage of sales, begin to increase. This normally occurs because the organization just has too many people on the payroll or too many people making too much money.4

Often in an economy that is going gangbusters I've observed many companies who overlook their payroll burden and salary load. They simply become bloated from a wages standpoint.

Be honest with yourselves, I bet many of you are overpaying certain staff members simply because they've been with you for many years. As long as the economy is roaring along you hand out raises year after year, whether deserved or not.

There are also many multi-generational family businesses in the lawn and landscape industry. Payroll can be "top heavy" in these companies as multiple partners or owners get a piece of the pie.

Since we're being candid, how about those business owners paying their spouses or other family members a wage for doing very little, or nothing at all? It's pretty common in our industry.

So how does this relate to the pandemic? It should be obvious. If you've been complacent in evaluating your wages and keeping payroll in line with sales volume now is the time to regain control.

At the very least I suggest you track and benchmark "wages as a percentage of sales". I track "salary load" for our company which is calculated based on percentage of gross margin rather than total sales. However you track this, determine a healthy range for your company to be in at all times.

Many of you have difficult decisions to make to maintain financial stability now and post-pandemic. Be the courageous and decisive leader that your company needs at this moment.

3. Increasing sales volume

Surprisingly, most entities that go broke do it during a period of an increase in sales volume.5

I know this sounds counterintuitive because many falsely believe companies fail because of a decline in sales volume. That's just not the case.

The facts are, however, that business is not a game of volume. Business is always a game of margin. If a business doesn't maintain gross margin at an adequate level, it is going to go bust, regardless of its sales volume.6

The mantra, "We can make it up in volume", is a myth and absolute bull shit.

Think about it rationally: How do companies typically "make it up in volume"? They cut prices. They offer discounts. This, in turn, naturally increases sales volume (Who doesn't love a great deal??).

While everyone is slapping each other on the back for their record quarterly sales numbers, your gross margin (as a percentage of sales) is dangerously declining due to the fact your cost of goods sold has either remained the same, or more likely, has increased.

Coming out of this pandemic, your first thought should not be, "Boy, we need to cut our prices so we can better compete against ABC Company and sell more work". Now isn't the time to give away work to "get your foot in the door".

Instead, you need to maintain a laser focus on selling the right work at the right price that is required to generate your ideal gross margin.

Again, business is not a game of volume. Business is always a game of margin. If you discount prices to increase sales you need to understand that you will have an on-going, lifetime battle for survival that, sooner or later, you are going to lose.7

Now is the time to hold firm, my friends.

---

Difficult times are still ahead and we will face many challenges post-pandemic. We're all in the same boat.

Aside from your health and well-being, financial stability is what I'm hoping for most for you and your business.

I hope this article and insight gets you thinking more critically about your finances and the numbers you track on a regular basis. You will need this financial diligence more than ever as we move forward together.

I encourage you to listen to this podcast Chad Diller, our Director of Client Success, and I did together about what you can do right now during this pandemic.

Be well and be safe.

If you want more candid insight like this please consider subscribing to our blog. Add your email address below to get new content delivered straight to your inbox.

Sources:

1. How to Sell at Margins Higher Than Your Competitors, Steinmetz and Brooks, page 3

2. How to Sell at Margins Higher Than Your Competitors, Steinmetz and Brooks, page 4

3. What You Can Be Certain About When There is Uncertainty Everywhere, David C. Baker

4. How to Sell at Margins Higher Than Your Competitors, Steinmetz and Brooks, page 4

5. How to Sell at Margins Higher Than Your Competitors, Steinmetz and Brooks, page 6

6. How to Sell at Margins Higher Than Your Competitors, Steinmetz and Brooks, page 6

7. How to Sell at Margins Higher Than Your Competitors, Steinmetz and Brooks, page 8